Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

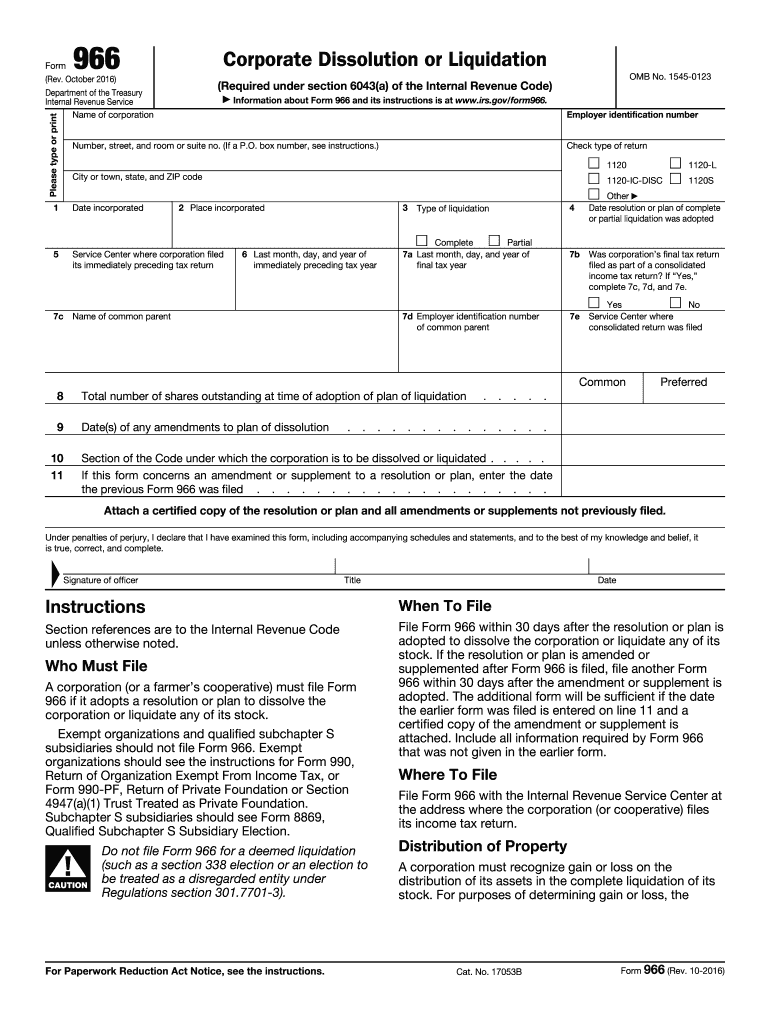

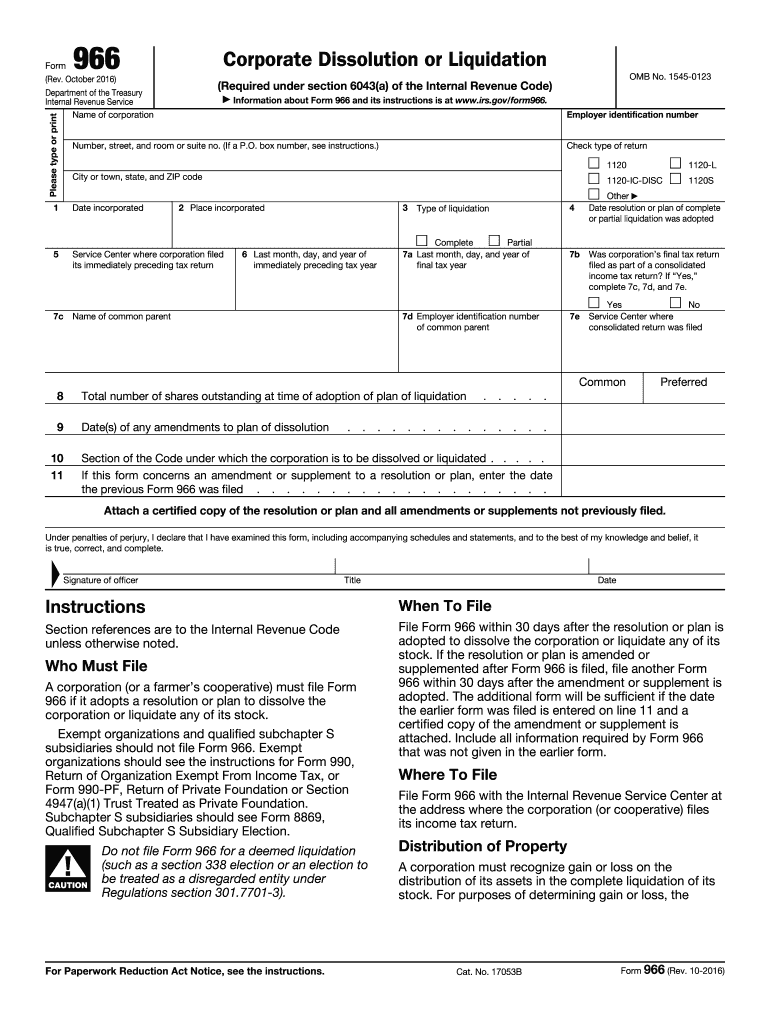

Form 966, Corporate Dissolution or Liquidation, is a required IRS tax form that must be filed by all U.S. corporations that are dissolving or liquidating. It must be filed with the Internal Revenue Service (IRS) within 75 days of the date of the dissolution or liquidation. The form is used to report any corporate assets distributed to shareholders, creditors, and other parties, as well as any income earned during the period of dissolution or liquidation.

What information must be reported on form 966?

Form 966 is used by companies to report the dissolution, termination, or substantial contraction of a corporation. The form must include the name of the corporation, its employer identification number (EIN), the date of the dissolution or termination, a description of the transaction, and the signature of an officer of the corporation.

When is the deadline to file form 966 in 2023?

The deadline to file Form 966 is March 15, 2023.

What is the penalty for the late filing of form 966?

The penalty for the late filing of Form 966 is $50 for each month the return is late, up to a maximum of five months, or $250.

Who is required to file form 966?

Form 966, also known as the Corporate Dissolution or Liquidation, must be filed by a corporation or other entity to finalize its dissolution or liquidation with the Internal Revenue Service (IRS).

How to fill out form 966?

Form 966, also known as the Corporate Dissolution or Liquidation Form, is used by corporations to provide the IRS with information regarding the dissolution or liquidation of the corporation.

Here are the steps to fill out Form 966:

1. Download Form 966: Visit the IRS website or use a trusted tax software program to download the Form 966.

2. Provide general information: Fill in the corporation's name, employer identification number (EIN), address, and the date of incorporation.

3. Check the appropriate box: Indicate whether the corporation is being dissolved or liquidated. Typically, corporations choose one or the other.

4. Describe the type of resolution: Briefly describe the board of directors' resolution to dissolve or liquidate the corporation, including the date of approval.

5. Provide additional information: If any distributions were made to the shareholders or officers as part of the dissolution or liquidation, include the details in this section.

6. Provide details of debts if any: If there were any outstanding debts or liabilities at the time of dissolution or liquidation, provide the description and value of each.

7. Verify and sign: Review all the information provided on the form, and ensure it is accurate and complete. The form should be signed by an authorized individual, usually the president or CEO of the corporation.

8. Submit the form: Send the completed Form 966 to the appropriate address mentioned in the instructions accompanying the form. Note that the submission may be different depending on the state where the corporation is located.

Remember to keep a copy of the completed Form 966 for the corporation's records.

It's important to consult with a professional tax advisor or attorney who can guide you through the process and ensure that all necessary steps are followed correctly as dissolving or liquidating a corporation can have significant legal and tax implications.

What is the purpose of form 966?

The purpose of Form 966 is to provide notification to the Internal Revenue Service (IRS) regarding the intent to dissolve a corporation, or liquidate any of its assets. This form is filed by the corporation's officers or legal representatives and it includes information such as the corporation's name, address, and Employer Identification Number (EIN), as well as the date and method of dissolution or liquidation. By submitting Form 966, the corporation informs the IRS about the termination of its activities and suggests that its tax obligations will be satisfied through the liquidation process.

How do I complete form 966 online?

pdfFiller has made it easy to fill out and sign irs form 966. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How can I fill out 966 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your fill out 966, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit form 966 on an Android device?

You can make any changes to PDF files, such as irs form 966, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.