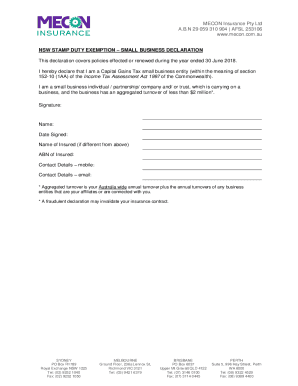

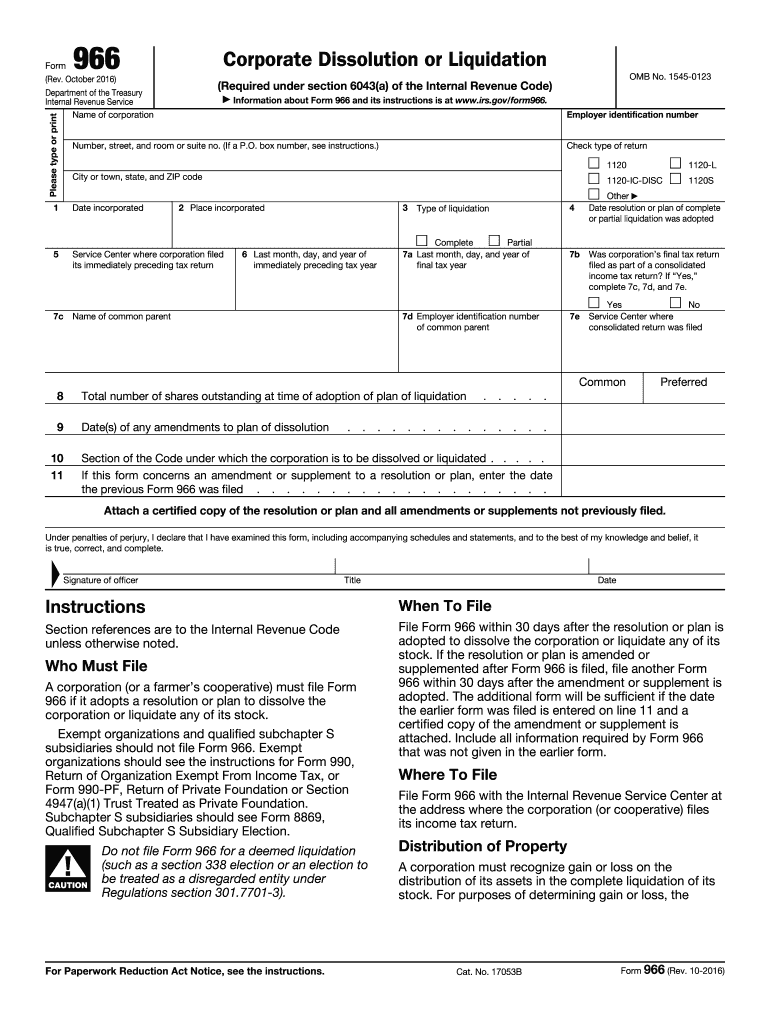

IRS 966 2016-2026 free printable template

Instructions and Help about IRS 966

How to edit IRS 966

How to fill out IRS 966

Latest updates to IRS 966

All You Need to Know About IRS 966

What is IRS 966?

Who needs the form?

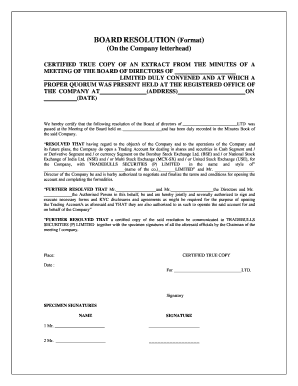

Components of the form

How many copies of the form should I complete?

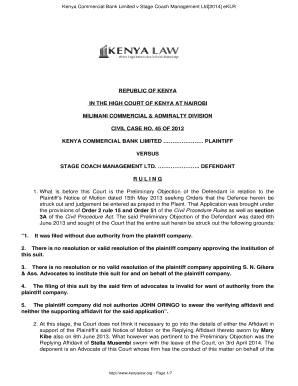

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 966

What should I do if I realize I made a mistake on my IRS 966 after filing?

If you discover an error on your filed IRS 966, you should file an amended version as soon as possible. It's essential to accurately indicate the changes and provide a clear explanation of the adjustments. This ensures that the IRS has the correct information on record.

How can I verify that my IRS 966 has been received and processed?

To confirm the receipt and processing status of your IRS 966, you can check directly on the IRS website or via their toll-free hotline. You may need to provide your personal information for verification, as well as details about the form submission.

What are common errors when filing the IRS 966 and how can I avoid them?

Common mistakes when filing the IRS 966 include incorrect data entry, missing signatures, and not following submission guidelines carefully. To avoid these errors, double-check all information for accuracy and ensure you've adhered to all instructions provided by the IRS.

Are electronic signatures accepted for IRS 966 submissions?

Yes, electronic signatures are acceptable for IRS 966 submissions if you are filing online. Ensure that your e-filing software supports this feature, as it complies with IRS regulations regarding electronic submissions.

What should I do if I receive an IRS notice after filing my IRS 966?

If you receive an IRS notice or letter after submitting your IRS 966, carefully review the document for specific instructions. Follow the guidelines provided, gather any necessary documentation, and respond promptly to address any issues raised.

See what our users say